Measuring Beyond The First Purchase With Customer Lifetime Value

Any marketer with a direct response focus is very familiar with a little success metric called Return On Ad Spend (aka. ROAS). If you have a ROAS of 5, you are effectively spending $100 on advertising and receiving $500 in revenue as a result. Sounds simple and effective enough, right?

Not entirely. ROAS doesn’t factor in how the customers you acquire through your marketing efforts behave over their lifetime with you. If a customer purchases from you again in say, a year’s time, the initial advertising dollar you spent on them, actually generated more than a 5x return.

That’s why customer lifetime value (CLV) is another important success metric to consider in your digital marketing strategy. It measures how valuable a customer is to your company over their entire relationship with you, is a strong indicator of customer experience, and is tangibly linked to revenue.

Customer lifetime value helps you to focus on long-term, company-wide growth. But, for many years, getting this view of a customer has been challenging. The consumer journey has continued to evolve, splitting across screens, and also online to offline.

Many businesses in the app space measure lifetime value – as they are operating in a tightly controlled environment. Google Analytics, Google Marketing Platform, and Facebook Analytics have also released a lifetime value metric that tracks the value generated from marketing and advertising campaigns. Lifecycle platforms like Emarsys, Active Campaign, and Klaviyo, which are designed to enhance customer experience will help you to measure lifetime value.

Why should we focus on customer lifetime value?

- Customer lifetime value tells you how much revenue you can expect one customer to generate over the course of their business relationship.

- Therefore, it helps you to identify a reasonable cost-per-acquisition. If the cost to acquire a new customer is greater than their lifetime value, then your advertising and marketing efforts aren’t making money overall.

- Therefore, knowing customer lifetime value, helps you to develop tangible and profitable customer acquisition strategies.

- It also helps you identify customer retention strategies that can help you provide a better customer experience, while bolstering up your profit margins.

- Considering that a vast majority of customer experiences occur online, your digital marketing strategy also has a strong influence on the customer journey and can be used to drive loyalty.

What factors play into the customer lifetime value equation?

Customer Lifetime Value = (Average Purchase Value x Average Purchase Frequency Rate) x Average Customer Lifespan

- Average Purchase Value = Total Revenue In A Time Period (Usually One Year) / Number of Purchases Over Same Time Period

- Average Purchase Frequency Rate = Number Of Purchases / Number of Unique Customers Who Made Purchases During That Time Period

- Average Customer Lifespan = Average Number Of Years A Customer Continues Purchasing From Your Company

When it comes to Mobile Apps, virality also gets considered:

- Lifetime value = Average Revenue Per User x (1/churn) + (Referral Value)

So, why is it challenging to measure customer lifetime value?

The concept is fairly simple, but when we start looking at multiple touchpoints and widely different customer consideration periods – customer lifetime value calculations become more difficult. Segregated teams and an inadequate tech stack can also make things tricky. You need to know all touchpoints where a customer creates value for your business and have a picture of the customer journey (understanding multiple purchases, behaviour patterns, and engagement).

What measures should you put in place in order to start calculating customer lifetime value?

At a starting point, the easiest way to start measuring customer lifetime value is to pull Google Analytics lifetime user value into your reporting model.

To open the Lifetime Value report:

- Sign in to Google Analytics.

- Navigate to your view.

- Open Reports.

- Select Audience > Lifetime Value.

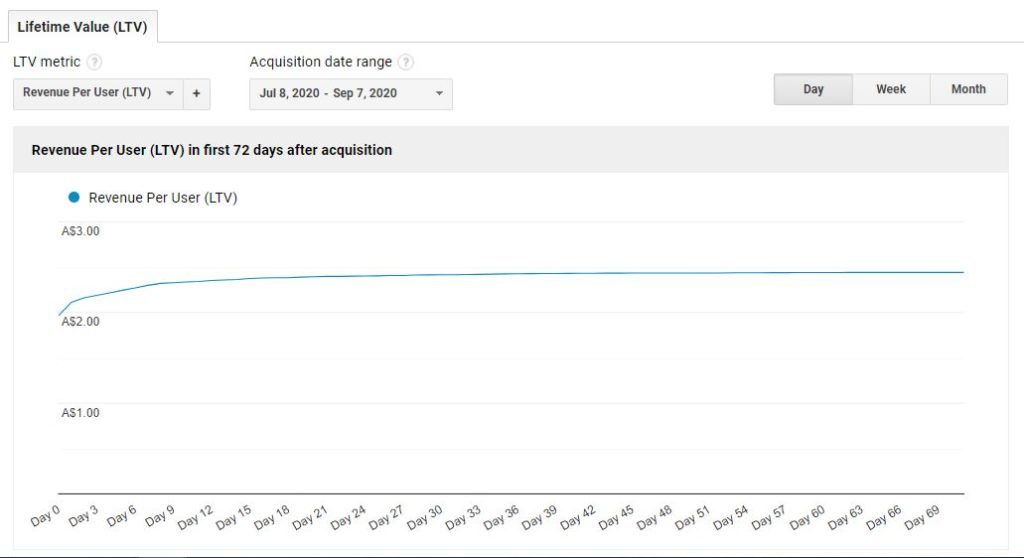

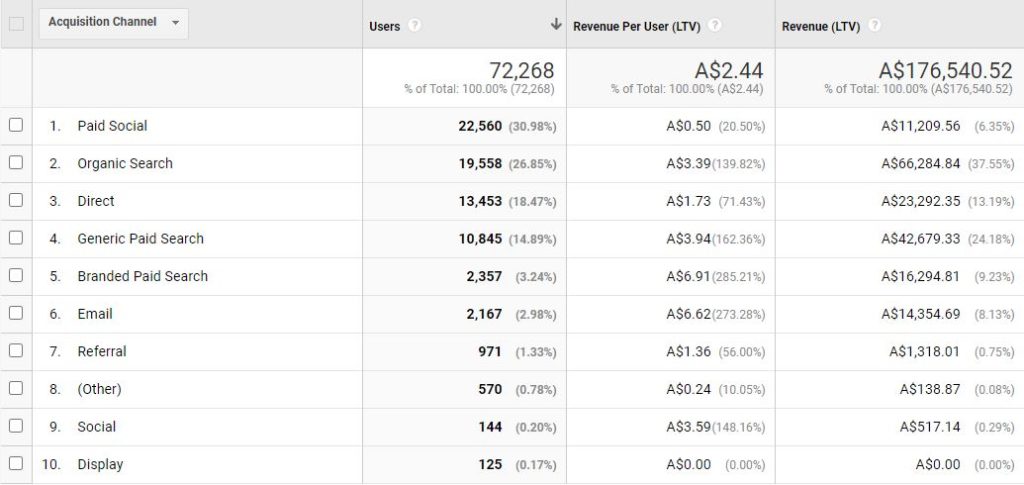

You can filter your results to understand which channel is delivering the best quality users. In the example below, you can see that ‘branded paid search’ is a massive contributor, even over and above ‘non-branded paid search’. The drawback is that Google Analytics offers a limited 90 day window, which is too short for most businesses to truly represent a ‘Customer Lifetime Value’. The reorder cycle can be far longer than that.

The report can still at least offer guidance. E.g. in the example below, the LTV user base averages 0.6 transactions in 90 days, so you could infer that the average re-order is approximately 178 days.

If you want to gain a deeper insight and have an accurate ‘view’ of a customer – a lot of work needs to be done.

- Update all of your systems (your CMS, CRM, CDP, and EMP) to center around a singular ‘Customer ID’. The unique identifier you use cannot be an email or phone number because they change frequently, and customers now typically have more than one that you would then need to be able to knit together.

- Create a data lake where you can begin combining all transactional data from your finance system, then pair these to the user profiles in your marketing stack.

- Combine the records of customers that may have more than one ID.

Once you have this full view you can see:

- The total number of transactions per customer

- The total period of time as a customer

- The overall revenue they have spent

You can also get a lot of value from being able to segment the customer base and understand the lifetime value of different personas. But we think the best part is being able to optimise all of your marketing efforts to look beyond the first purchase and to drive long term, company wide growth.